Investing is one of the best ways to grow your wealth and secure your future. But what are the 7 types of investments, and which ones should you consider? With so many options—stocks, bonds, real estate, and more—it is important to understand how each investment works and which suits your financial goals.

In this guide, we will explore 7 most popular types of investments, breaking down their benefits, risks, and how they fit into your portfolio. Whether you’re looking for high returns from stocks, stable income from bonds, or long-term growth through real estate and mutual funds, knowing these investment options will help you make smart financial choices.

From traditional assets like stocks and bonds to modern alternatives like cryptocurrencies and commodities, we will give you the knowledge to invest with confidence. Whether you are just starting or already investing, this guide will help you understand the 7 types of investments and how they can support your financial success.

Table of Contents

What Are the 7 Types of Investments?

Building wealth and securing your financial future starts with understanding the 7 types of investments. Each investment option offers different levels of risk, potential returns, and strategies, making it important to choose the right mix based on your financial goals.

In this guide, we’ll explore the 7 most popular types of investments, explaining how they work, their benefits, and potential risks. Whether you want high returns from stocks, stable income from bonds, or long-term growth through real estate and mutual funds, knowing these investment options will help you make informed financial decisions.

By the end, you’ll have a clear understanding of which types of investments best fit your goals—whether you’re a beginner making your first investment or an experienced investor refining your strategy. Let’s dive into the 7 types of investments that can set you up for long-term financial success.

1. Stocks (Equities)

Stocks (also known as equities) represent ownership in a company. When you buy stocks, you become a part-owner and can benefit if the company grows and its stock price increases. Stocks may also pay dividends, which are a portion of the company’s profits.

While stocks come with risks, they offer the potential for high rewards. Investing in the right companies can yield significant returns over time.

One way to reduce risk is through diversification. This involves investing in stocks from different sectors (e.g., technology, healthcare, energy). By spreading investments across industries, if one sector struggles, others may perform better. This strategy helps minimize risk and increases your chances of long-term success.

Among the 7 popular types of investments, stocks are a top choice for wealth growth—especially for investors willing to take on some risk for greater potential rewards.

Advantages:

- High growth potential, especially for long-term investments.

- Potential for dividends and capital gains.

Disadvantages:

- Can be volatile, causing significant price swings.

- Requires careful research and monitoring.

Risk Factor: High – Stock prices can fluctuate dramatically.

Where to Start Investing: Open a brokerage account with platforms like Zerodha, Upstox, and Dhan.

2. Mutual Funds

Mutual funds are a popular investment option, especially for beginners. They pool money from multiple investors to create a diversified portfolio of stocks, bonds, and other securities, managed by professional fund managers.

Ideal for salary earners or new investors, mutual funds require minimal effort and financial knowledge. Due to this simplicity and professional management, mutual funds are often the first choice of investment type among salary earners and beginners. For safer investment options, consider index funds like Nifty 50 or Sensex 30, which are popular type of investments for those seeking stability and diversification.

Depending on your risk tolerance, you can choose from large-cap, mid-cap, or small-cap mutual funds to balance risk and reward.

Before investing, it’s a good idea to consult with a financial advisor to ensure you’re making the right choices based on your goals and risk capacity.

Advantages:

- Diversification reduces risk.

- Managed by professionals, saving you time.

Disadvantages:

- Fees and expenses can eat into returns.

- Less control over individual investments.

Risk Factor: Moderate – Depends on the assets in the fund.

Where to Start Investing: Many brokerage platforms offer mutual fund investments, such as Zerodha, Upstox, and Dhan, or you can start investing directly through an Asset Management Company platform.

3. Exchange-Traded Funds (ETFs)

An ETF (Exchange-Traded Fund) is a type of investments fund that holds a diversified portfolio of assets, such as stocks, bonds, or commodities, similar to a mutual fund. However, unlike mutual funds, ETFs trade on stock exchanges like individual stocks, offering the flexibility to buy and sell throughout the trading day at market prices.

ETFs typically have lower expense ratios compared to mutual funds, making them a cost-effective choice for investors. They provide an efficient way to gain exposure to specific sectors, commodities, or market indices, allowing for broad market diversification.

With liquidity, transparency, and tax efficiency, ETFs are a popular choice for both beginners and experienced investors looking for an easy way to invest in a wide range of assets.

Advantages:

- Lower fees than mutual funds.

- Easy to trade and diversify.

Disadvantages:

- Risk of market volatility like stocks.

- Limited customization of holdings.

Risk Factor: Moderate to high – Depends on the underlying assets.

Where to Start: ETFs can be purchased on platforms like Zerodha, Upstox, and Dhan.

4. Commodities

Commodities are basic goods or raw materials traded on financial markets. These include natural resources like gold, oil, and agricultural products such as wheat, coffee, and cotton. As a popular types of investments, commodities are typically divided into two categories: hard commodities (e.g., metals, oil) and soft commodities (e.g., grains, livestock). This investment option allows individuals to diversify their portfolios and benefit from global market trends.

Investing in commodities offers exposure to global supply and demand dynamics, as their prices often fluctuate based on factors like weather, geopolitical events, and economic trends. Commodities can serve as a hedge against inflation and help diversify investment portfolios, as their performance often moves independently of stocks and bonds.

They can be traded directly through futures contracts, ETFs, or commodity mutual funds. While commodities offer significant growth potential, they can also be volatile, making them more suitable for investors who understand the risks and are looking to diversify their investments.

Advantages:

- Can hedge against inflation and economic downturns.

- Diversifies your portfolio with real-world assets.

Disadvantages:

- Highly volatile, especially in commodities like oil.

- Requires specialized knowledge for direct investment.

Risk Factor: High – Prices can be influenced by geopolitical and environmental factors.

Where to Start Investing: Commodity ETFs or futures contracts can be accessed via most brokerage platforms, like Zerodha, Upstox, and Dhan.

5. Bonds

Bonds are one of the most reliable types of investments, issued by governments, municipalities, or corporations to raise capital. when you invest in bonds, you lend money to the issuer in exchange for regular interest payments and the return of your principal at maturity. bonds are considered lower-risk compared to stocks, making them an attractive option for individuals seeking steady income with reduced risk.

There are three popular types of bonds:

- Municipal Bonds: Issued by state or local governments, these bonds are often tax-exempt and offer lower risk with steady income through interest payments.

- Government Bonds: Issued by national governments, these are considered low-risk and offer stable returns.

- Corporate Bonds: Issued by companies, they offer higher returns but come with slightly more risk than government bonds.

Advantages:

- Regular income through interest payments.

- Lower risk compared to stocks.

Disadvantages:

- Lower returns compared to stocks.

- Susceptible to interest rate changes.

Risk Factor: Moderate – Safe, but returns are typically lower than equities.

Where to Start Investing: Bonds can be purchased through brokerage accounts such as Zerodha, Upstox, and Dhan

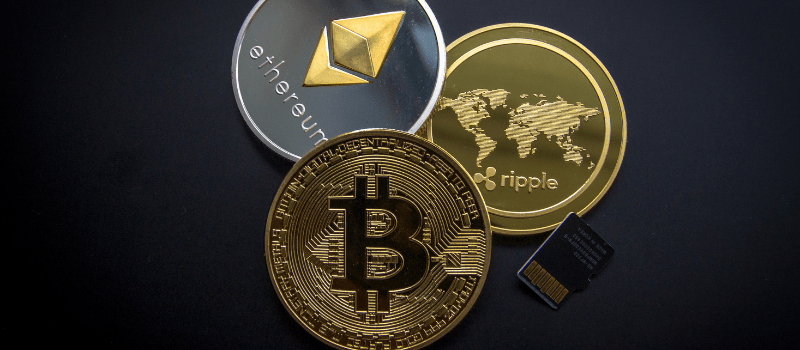

6. Cryptocurrencies

Cryptocurrencies are digital currencies that use blockchain technology for secure, decentralized transactions. Bitcoin is the most well-known, but others like Ethereum and Ripple are also popular. Cryptos offer benefits such as faster transactions and global accessibility, without relying on traditional banks.

However, cryptocurrencies are highly volatile and come with significant risk. Financial experts often recommend that only a small portion—typically 5% to 10% of your total investment—be allocated to cryptocurrencies, depending on your risk tolerance and age. Younger investors may afford more risk, while older investors should keep exposure lower. Always consult a financial advisor to determine the right allocation for your portfolio

Advantages:

- High growth potential.

- Decentralized and not influenced by traditional financial systems.

Disadvantages:

- Extremely volatile.

- Regulatory uncertainties and scams.

Risk Factor: Very high – Cryptocurrencies can experience wild price swings.

Where to Start Investing: Platforms like CoinDCX, Mudrex, and Delta Exchange India allow you to buy and trade cryptocurrencies easily.

7. Real Estate

Real estate involves investing in properties like land, residential homes, or commercial buildings. It is typically a long-term investment that can provide both capital appreciation (property value increase) and passive income (rental income).

Real estate is a popular investment choice for diversifying portfolios. It is often less volatile than stocks and can serve as a hedge against inflation.

There are multiple ways to invest in real estate:

- Buying property directly

- Investing in Real Estate Investment Trusts (REITs)

- Participating in real estate crowdfunding platforms

While real estate offers attractive returns, it requires a larger initial investment. There are also ongoing costs, such as maintenance, property taxes, and insurance. Additionally, real estate is less liquid, meaning it may take time to sell if needed.

Despite these factors, real estate remains a solid investment for long-term wealth-building.

Advantages:

- Tangible asset with long-term appreciation.

- Provides a hedge against inflation.

Disadvantages:

- Requires significant capital and management.

- Liquidity issues with direct real estate investments.

Risk Factor: Moderate – Subject to market and economic fluctuations.

Where to Start Investing: You can start by investing in REITs through a brokerage or directly with property investment platforms.

Conclusion: 7 Types of Investments

Understanding the 7 types of investments helps you make informed decisions aligned with your financial goals and risk tolerance. Each investment type offers distinct benefits and risks.

Stocks and cryptocurrencies cater to high-risk, high-reward investors, while bonds provide stability.

Mutual funds, ETFs, and real estate offer balanced growth with diversification.

Always consider your financial objectives and timeline when making investment decisions. Conduct thorough research or consult with a financial advisor to build a diversified portfolio that can weather market fluctuations and achieve long-term success.

FAQs: 7 Types of Investments

Are stocks a good investment for long-term growth?

Yes, stocks (equities) have historically provided strong long-term growth. While they come with higher short-term volatility, investing in well-researched companies can lead to significant returns over time, especially with a long-term investment horizon.

How do bonds differ from stocks?

Bonds are debt instruments, meaning when you buy a bond, you’re essentially lending money to an organization (government or corporation) in exchange for periodic interest payments. Stocks, on the other hand, represent ownership in a company, and their returns are based on the company’s performance and market conditions.

What is a good way to diversify my investment portfolio?

Diversification is key to reducing risk. You can diversify by investing across different asset classes, such as stocks, bonds, real estate, and commodities. Mutual funds or ETFs are also great for diversification as they pool investments in various securities.

Are cryptocurrencies a safe investment?

Cryptocurrencies can be highly volatile and are considered high-risk investments. While they have the potential for significant returns, they can also experience steep losses. It’s essential to do thorough research and invest only what you’re willing to lose.

What are the advantages of investing in real estate?

Real estate can provide a steady income through rental properties and has the potential for long-term capital appreciation. It’s also considered a good hedge against inflation. However, it requires significant upfront capital and can be less liquid compared to other type of investments.

How can I start investing with a small budget?

If you have a small budget, consider starting with low-cost options like ETFs, mutual funds, or fractional shares of stocks. These allow you to diversify your portfolio without needing a large initial investment. Many brokers also offer commission-free trading, making it easier to get started.

How can I minimize risks when investing?

To minimize risks, diversify your investments across different asset classes, maintain a long-term strategy, and do thorough research before making decisions. Regularly reviewing your portfolio and adjusting based on market conditions can also help mitigate potential losses.

How often should I review my investment portfolio?

It is generally recommended to review your portfolio at least once a year or whenever there are significant changes in the market or your financial situation. This ensures your investments remain aligned with your goals and allows you to make adjustments as necessary.

What is the difference between passive and active investing?

Active investing involves selecting individual investments and managing your portfolio actively, often with the help of a financial advisor. Passive investing, on the other hand, involves strategies like index funds or ETFs, where you invest in a broad market segment and let the investments grow with minimal intervention.

Should I invest in international markets?

Investing in international markets can help diversify your portfolio by providing exposure to global economic trends and opportunities. However, it also comes with additional risks, such as currency fluctuations and geopolitical factors, so it’s important to do proper research before investing in foreign markets.

Can I lose all my money by investing?

Yes, it is possible to lose your investment if the market or the asset you invested in performs poorly. However, with diversified investments and a balanced approach, the risk of losing all your money is reduced. It’s important to manage risk carefully and not invest more than you can afford to lose

Is it better to invest in a single asset or multiple assets?

Investing in multiple assets helps spread out risk, which is a key principle of diversification. By not putting all your money into a single asset, you reduce the chances of a total loss. Diversification allows you to capitalize on different market sectors and conditions.

How do market trends affect my investments?

Market trends can influence the value of your investments. Bull markets (rising markets) may lead to higher returns, while bear markets (declining markets) can lower the value of your holdings. Staying informed about market trends and economic conditions can help you adjust your strategy accordingly.

What are the 7 types of investments?

The 7 types of investments are stocks, bonds, mutual funds, real estate, commodities, ETFs (exchange-traded funds), and cryptocurrencies.

Disclaimer

The content provided in this article about the “7 Popular Types of Investments” is for informational and educational purposes only. It is not intended to offer specific investment advice, financial recommendations, or professional guidance. Investment decisions carry risks, and readers should always consult with a qualified financial advisor or conduct personal research before making any investment choices. The author and website make no representations about the accuracy, reliability, or completeness of the information provided and are not responsible for any financial losses resulting from reliance on this content.

if you want to read more content related this click here